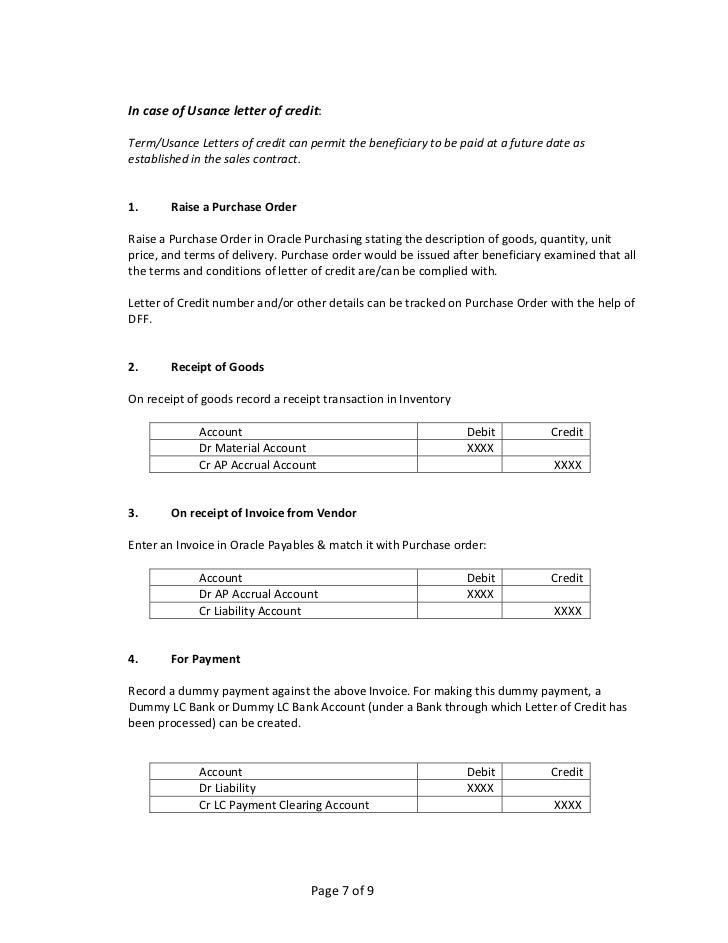

On top of all of that, you also need to get paid-and you’re likely going to want a guarantee that payment will be made, especially since you won’t have much recourse to get your money if your buyer is on the other side of the ocean. There are plenty of factors to consider, such as getting the order shipped and making sure it arrives properly and on time. Let’s say your business receives a big order from an overseas company. A letter of credit helps mitigate the risk of either party not living up to their obligations, which can be essential for a business of any size. The bank serves as an intermediary for payment, issuing a letter of credit that offers protection against a deal going south. In this instance, a letter of credit is the way for an impartial third party-in this case, the bank-to guarantee that your customer can (and will) pay you for the goods or services provided. As a business owner, you may request a letter of credit from a customer to guarantee payment for products or services you’re providing. Article Table of Contents:Ī letter of credit, or credit letter, is a bank guarantee that a specific payment will be made. In this guide, we’ll break down what a letter of credit is, how a letter of credit helps small business owners, and how you can take advantage of one if the occasion demands it. Ī letter of credit is a more complicated financial transaction than those you might be more accustomed to, but it might be the best course of action for your business at some point. A letter of credit serves as a way to help ensure your vendor will remain true to their word to pay you, all without having to rely on a personal guarantee or verbal agreement.

One of the best and most common methods, in this case, is a letter of credit. If you have a more complicated transaction-say with an international party-you may need a surefire way to make sure you get the money you’re due. Others are a little more tricky, depending on the situation. Some are simple, like cash, checks, or wire transfers. When you’re a small business owner, there are a variety of ways to get paid by your customers and vendors.

0 kommentar(er)

0 kommentar(er)